- Protect your family Death & disability

- + More than 200 high-performance funds to choose from

- Yields + 7% per year

- 🎁 200 free if subscribed on time

Third Pillar

Deduct 7,258 / year in taxes.

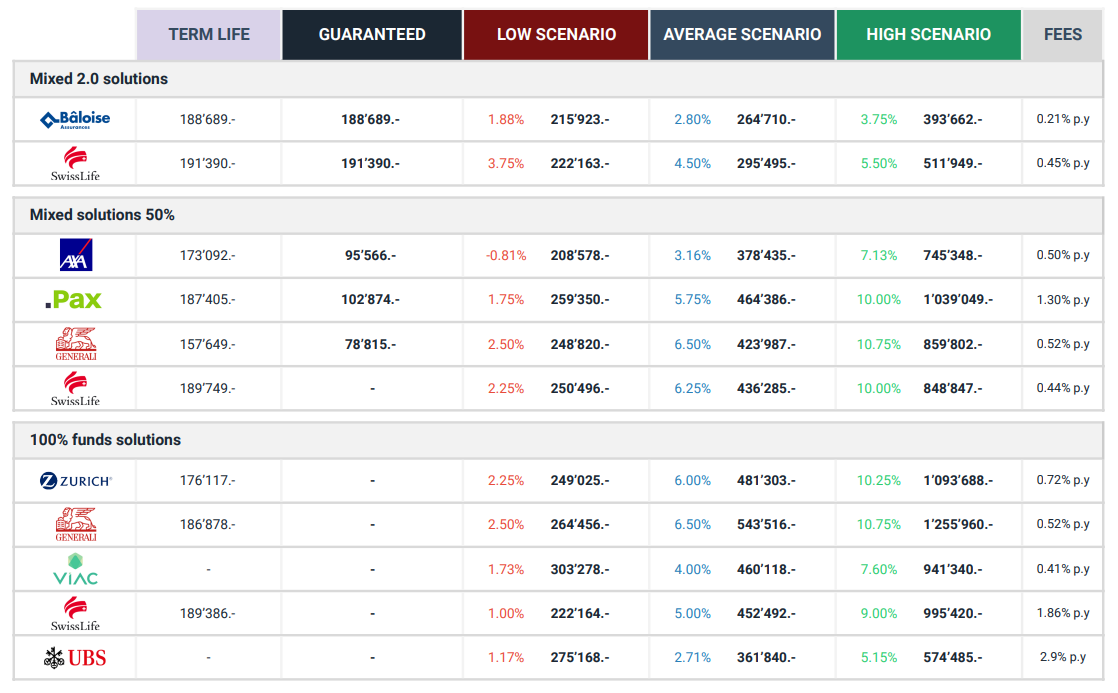

- 41 banks and insurance companies

- Customized comparison

- Received in 3 minutes

Flash offer until August 20, 2025

CHF 200 free with all new 3rd pillar insurance!

Why are our 3rd pillar 3A insurance consulting services 100% free?

As official partners of almost the entire Swiss insurance market, we are directly remunerated by these 41 companies, at no extra cost to you.

How can I be sure that our 3A advice is neutral?

Not all companies pay us the same, but this has no bearing on the advice we give you. Our Google ratings and reviews bear witness to this!

Is our 3A 3rd pillar insurance comparator really transparent?

Unlike the rest of the Swiss market, we include all 3rd pillar 3A offers direct from the insurance companies in your comparison. This way, you can verify all the figures we give you.

Thanks for the effort in my case.

Once again, thank you Mr Hamo, thank you Sparta Group.

Best wishes for the future.

I recommend it!

I got in touch with David who was very transparent and efficient.

I like his style and appreciate his time.

I would like to thank you for your very efficient and prompt work

your kindness and positive attitude are much appreciated.

Yours sincerely Denis Thioly

Always ready to provide support and further explanations.

His explanations were clear and understandable.

He has been indispensable and inspires the confidence and sympathy I would expect from an advisor.

I've never seen a more diplomatic, competent and hard-working professional in this field than him.

I really appreciated his availability and responsiveness.

Personalized service and fast turnaround. I am delighted!

Thanks for everything Xavier 🙂

I'd certainly recommend their service.

Thank you very much.

I highly recommend SpartaGroup's services.

We’ll support you all the way and beyond, free of charge.

The importance of comparing 3rd pillar insurance offers

The Swiss pension system is based on three pillars, each of which plays a crucial role in long-term financial security. Among these, the third insurance pillar, also known as individual pension provision, is a voluntary solution designed to supplement 1st and 2nd pillar benefits. It enables Swiss citizens to build up personal savings – often tax-advantaged – to prepare for retirement, finance projects and guard against the unexpected.

In this context, taking out 3rd pillar insurance is a strategic decision. But with so many different products on offer, it’s essential to compare third-pillar insurance products carefully. Using a Swiss 3rd pillar calculator, you can make an informed choice based on a number of criteria:

Tax optimization

Contributions to 3rd pillar insurance plans (notably 3rd pillar 3A and sometimes 3B) can be deducted from taxable income. However, conditions vary from one provider to another. Compare 3rd pillar insurance solutions to maximize these tax advantages.

Performance and conditions

Not all institutions offer the same performance levels for their 3rd pillar insurance. To ensure that your savings grow efficiently, it’s crucial to compare returns, early withdrawal conditions and guarantees in the event of disability or death.

Flexibility

Some3rd pillar insurance products offer invaluable flexibility: modulation of payments, temporary suspension, adjustment of investment strategy… These are just some of the factors to take into account when choosing an insurance product tailored to your needs.

Coverage and protection

Beyond the savings aspect, manythird-pillar insurance contracts include cover for death, disability and other risks. Comparing these coverages is essential to protecting your loved ones and securing your future.

Cost transparency

Good returns can be offset by excessive costs. By comparing3rd pillar insurance policies, you can more easily identify hidden costs and choose the most cost-effective solution.

Market competitiveness

Competition between players in thethird-pillar insurance market stimulates innovation, improves terms and conditions, and enables you to benefit from ever more advantageous offers.

Preparing for the future

The third pillar of insurance is an indispensable tool for preparing for retirement or other life projects with peace of mind. Choosing the right insurance guarantees lasting financial security.

In short, taking out a 3rd pillar insurance policy that’s right for you is a decisive step towards securing your future and that of your loved ones. By using a neutral, free 3rd pillar insurance comparison service, you can optimize your tax advantages, choose the best insurance and invest in your future with confidence.