3rd Pillar: Banking or Insurance?

Should I take out my 3rd Pillar with a bank or insurance company?

To build up your capital, you have quite rightly chosen to set up a3rd pillar. You’ve made the right choice, as you’ll benefit from numerous advantages, particularly in terms of tax. But where should you bank or insure your 3rd pillar?

Let’s take a look at the strengths and weaknesses of each solution to help you make the right choice.

What are your banking and insurance investment choices ?

There are a number of 3rd pillar banking and insurance solutions, but are they really the same? While some forms of investment exist in both, not all do. Let’s find out how your money works in a bank or insurance company.

Bank: The classic 3A bank account allows you to invest your money securely. Interest rates, ranging from around 0% to 1.5%,do not leave much to be desired. to make big gains. So your return will be mainly on the tax savings.

Insurance: the classic 3rd pillar in insurance is almost identical to that in banking. The big difference is that the insurance will give you a minimum contractual sum guaranteed. This guarantee is between 90% and 105%. This sum will be supplemented by surpluses based on insurance results. These surpluses are currently around 2% a year.

100% investment funds Investment fund solutions are broadly identical in operation between banking and insurance solutions. You invest your money in a fund and choose the level of shares it will contain. You can also opt for an investment theme, or build your fund assets according to your preference. This is a high-yield solution, but it’s also a risky one. There is no minimum security, and you could theoretically lose everything. These investments can currently averaging between 7% and 9% a year per year.

With interest rates low and investment funds risky, insurance companies have developed so-called mixed solutions. The mixed solution is therefore an exclusivity found only in insurance. These give you a guaranteed minimum amount, which you define between 10% and 90%, and then invest the remainder in a fund. These solutions enable you to achieve a high return of between 5% and 9%, while benefiting from a minimum guarantee providing you with a degree of security.

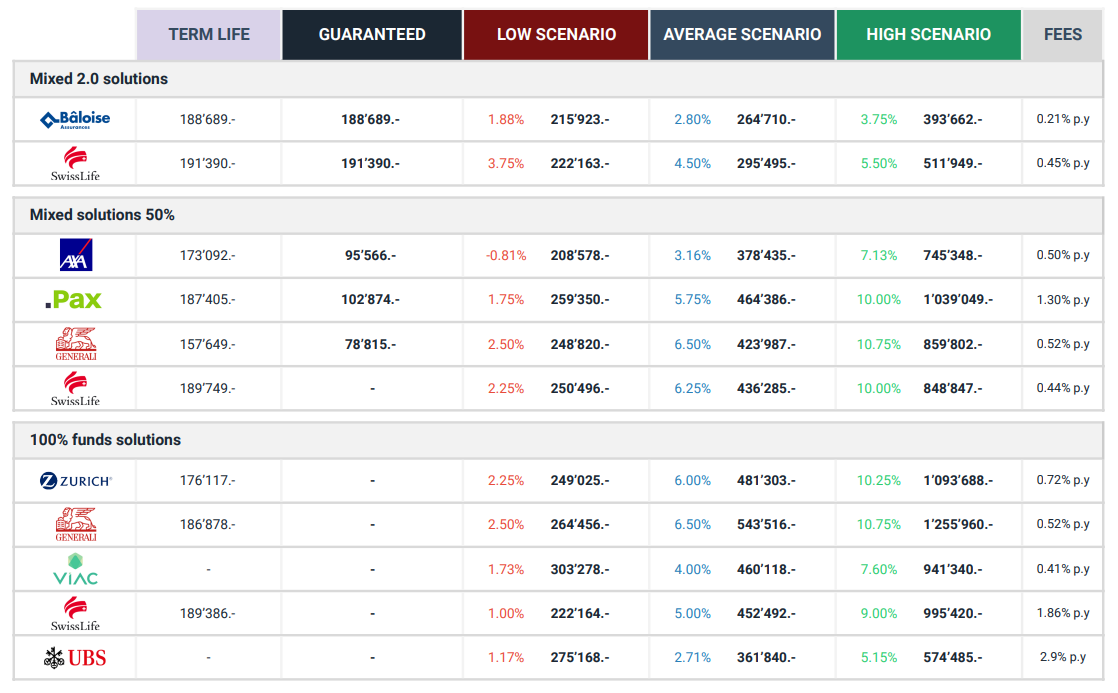

Example of a bank and insurance comparison

- Ask us all your questions

- Request as many variants as necessary

- We're with you every step of the way, free of charge.

What’s the difference in commitment?

We regularly read that for a short-term investment horizon, the bank is more suitable. Insurance should be preferred for the long term. But why do we say that? When will the 3rd pillar differ between a bank and an insurance company? Let’s take a look at the differences between withdrawals, payments and redemptions.

Bank: There is a major difference between opening a 3rd pillar account with a bank or an insurance company. As far as the bank is concerned, you open a 3A account. So there are no rules about how often you have to pay. In fact, once your account is open, you can pay in the amount of your choice on a monthly basis, or annually at the time of your choice. The only constraint is to respect the maximum deductible amounts set by the government .

Insurance: insurance is no longer an account opening but a contract. While this contract offers you additional guarantees, it also requires you to respect certain guidelines. You define the annual amount and payment frequency in advance. However, you can make an additional payment at the end of the year to top up your savings to the maximum deductible amount. However, lowering your premium will be penalizing, and there could be costs involved, so it’s important to set a premium that you can pay on a regular basis.

Theoretically, the duration of the payment is regulated by the confederation within the framework of a 3A. In fact, it’s a savings plan designed for retirement, and it’s until retirement that the solution will be planned. In practice, it’s slightly different. In fact, whether it’s banking or insurance, you have the freedom to stop your solution at any time, without notice.

Bank: concerning the commitment period, a 3a account requires no minimum term. What’s more, in the event of withdrawal, there are no penalties and you get back your entire investment. However, if you have invested in an investment fund, be sure to check the current share price. This one deserves your full attention, as there is no minimum guarantee.

Insurance insurance:as a contract, it requires commitment to offer long-term guarantees and prospects. Since this is a contract, the amount will be subject to what is known as the cash surrender value. If the contract is interrupted, you may be penalized if you take back your assets shortly after the investment: it takes between 8 and 12 years for these penalties to disappear. You will then obtain surrender values higher than the money paid in. That’s why insurance is often much more advantageous in the long term than in the short.

What is the guarantee against bankruptcy bank or insurance company?

In banking, since the 2008 crisis, banks have had to increase the maximum amount they can reimburse in the event of bankruptcy. This sum has risen from CHF 30,000 to CHF 100,000. But is this sum really guaranteed? Let’s find out why.

The deposit guarantee would put you in second place, after the bank’s employees and their salaries, in the event of repayment. It is therefore interesting to ask the following question: could the bank repay all its creditors to the tune of CHF 100,000 at the same time?

Insurance covers the full amount of the capital initially guaranteed in the contract. In fact, insurance companies are contractually required to have their money securely available at all times. The guarantee against insurance bankruptcy is therefore total.

Although this happens very rarely, it is important to remember that some major financial institutions have already gone bankrupt.

Therefore, it is worth examining how you are covered in a 3rd pillar bank or insurance.

What are the disability and death benefits?

Although the main purpose of a 3rd pillar is retirement, tax planning or an important life goal, you may be wondering what would happen to your 3rd pillar in the event of disability or death. If the bank has no risk option to offer, the insurance company will generally include it in its 3rd pillar at an attractive price.

Although optional, these risk coverages can be very interesting and are often recommended.

The lump-sum death benefit offers you a fixed amount, often identical to the final guaranteed sum, as soon as the file is validated. This is equivalent to a lower-cost life insurance lump sum that would be paid to your heirs should anything happen to you before the end of the policy. This capital will protect your loved ones against life’s risks.

It is also possible to define the amount desired in the event of death, and therefore to increase or decrease it.

Like the death benefit, this is an option that you can decide whether or not to include. It protects you against the risks associated with disability due to illness or accident. The principle is simple: the insurance company undertakes to pay the premiums on your behalf should you become disabled for the entire duration of the contract or for the entire duration of the disability.

The disability pension is different from the exemption. This time, you choose in advance the amount the company will pay you in the event of disability. The amount and type of disability coverage you choose should be calculated with a professional using a pension analysis.

In the event of a long-term illness, we generally receive between 50% and 60% of our income.

What happens to my 3A if I go abroad?

Generally speaking, when you set up a 3rd pillar, you had a long-term objective in mind. However, your plans may change. What happens if you leave Switzerland?

The bank will offer you two choices if you need to go abroad. The first would be to close your account and withdraw your balance in order to start saving elsewhere. The second is to stop payments without withdrawing your credit. In this case, the money will remain in your 3A account until you retire.

Be careful when your assets have been invested in investment funds. Some banks require you to close your assets and therefore sell your investment funds if you move abroad. So it’s important to plan ahead to avoid being dependent on the market.

The insurance will also allow you to withdraw your assets or leave them within the insurance, but in the event of premature termination, will penalize you according to its surrender values. If you wish to dispose of your assets freely, this is not the best solution. There is, however, a popular option for expats: the switch.

This switch will enable you to continue your 3rd pillar from abroad. In fact, you will be able to convert your 3rd pillar 3A into a 3rd pillar 3B, at no cost and with no change of solution. You’ll no longer enjoy tax savings, but you’ll be able to keep your guarantees and continue contributing to your projects. It’s a solution we recommend to keep your retirement savings on target.

How can I compare 3rd pillar banking and insurance products?

Whether it’s banking or insurance, it’s important to compare different solutions, because not all solutions are created equal.

We recommend that you analyze the investment’s projected figures, as well as its performance history. So you can be sure you’re making the right choice.

To this end, we have developed an online solutions comparator. It allows you to define your investment profile and then compare the best banking and insurance solutions. We invite you to try it out, and will be happy to advise you.