Maximum deductible amount 3rd pillar 2026

Maximum deductible amounts for a 3rd pillar 3A in 2026

Here are the maximum deductible amounts for a 3rd pillar 3A in 2026 :

- CHF 7’258.- par an pour les employés soumis LPP

- CHF 36,288 per year for self-employed persons (20% of income, up to a maximum of CHF 36,288)

- 20% of income, for a person who does not contribute to the LPP but still earns a salary.

This remains the same as in 2025.

The maximum deductible amount is steadily increasing, but why? Approximately every two to three years, the Confederation announces new maximum deductible amounts, thereby increasing the maximum amount. The average increase is around CHF 80. In fact, as the cost of living rises too, and in order to offset these increases, the confederation allows us to deduct and save more, which is good news. For your information, the last time the maximum deductible amount of a 3rd pillar changed was on January 1, 2021.5

Maximum deductible amounts in 2026 for a 3rd pillar 3B in Geneva

Maximum deductible amounts for 3rd pillar 3B in 2026, for the following persons living in the canton of Geneva:

Per year for singles:

- CHF 2,200 for people with a 2nd pillar (pension fund).

- CHF 4,400 for persons not contributing to a 2nd or 3rd pillar 3A plan

Per year for married people/registered partners living in the same household :

- CHF 3,300 for a couple affiliated to a 2nd pillar pension fund.

- CHF 4,950 if one of the two does not contribute to a 2nd or 3rd pillar 3A plan

- CHF 6,600 if both spouses or partners do not contribute to a 2nd or 3rd pillar 3A plan

Deductions that add up for each child you have on your tax return:

- CHF 900 extra for parents with a 2nd pillar pension.

- CHF 1’350.- if one of the two does not contribute to a 2nd or 3rd pillar 3A plan

- CHF 1’800.- if both parents do not contribute to a 2nd or 3rd pillar 3A plan

The total amount deducted is for the household, so it is possible to put it on a particular person and deduct it from the family return. What’s more, it’s important to know that the 3rd pillar 3B can only be taken out with an insurance company, not a bank.

Maximum deductible amounts in 2026 for a 3rd pillar 3B in Fribourg

Maximum deductible amounts for 3rd pillar 3B in 2026, as in 2025, for the following persons living in the canton of Fribourg:

- CHF 750 per year for a single person.

- CHF 1,500 for a married couple or a couple in a registered partnership.

It is entirely possible to create a 3rd pillar 3B in the name of one of the couple and deduct it from the household tax return.

How to choose?

There are many different 3rd pillars, each with its own advantages and disadvantages. But how do you choose?

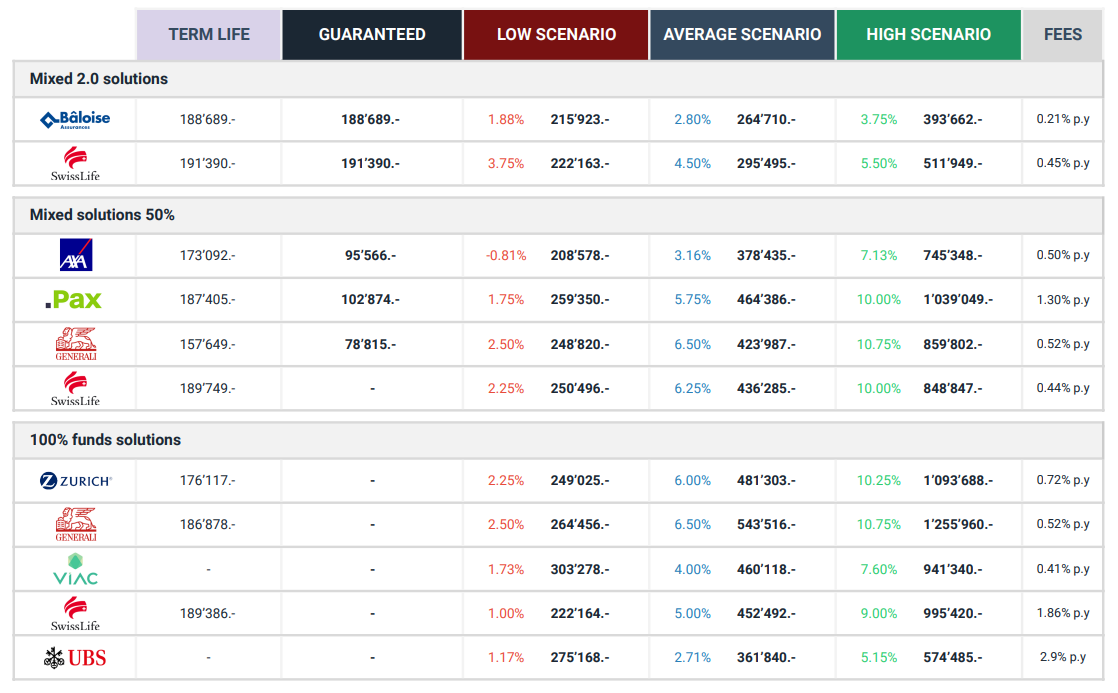

It’s important to put out a wide-ranging invitation to tender, so that you can compare the different solutions and get the best 3rd pillar on the market.

It’s also important to observe and compare projected yields. The % needed to get there is also important. Although the past doesn’t always reflect the future, we feel it’s important to highlight performance histories and thus observe how the solution has performed in the past.

With this in mind, we have developed an online 3rd pillar banking and insurance comparator, which will enable you to obtain a personalized comparison of the best solutions.

Example of a 3rd pillar comparison

- Ask us all your questions

- Request as many variants as necessary

- We're with you every step of the way, free of charge.