The 3 3rd pillar solutions

The traditional 3rd pillar

Return at risk

Guaranteed portion

Strengths and weaknesses

- 100% secure, no risk of loss

- Surplus or interest added to guaranteed capital

- Low yield

Potential yields

- Bank: capital saved + 0% to 1.5%.

- Insurance: capital guaranteed + 1.5% to 2%.

How traditional 3rd pillar banking works :

This solution works like a savings account, but in 3A. The money is not invested in the markets, but simply deposited in the account. The bank will pay you an interest rate currently between 0% and 1.5%.

How traditional 3rd pillar insurance works :

As with the banking solution, the money will not be invested on the markets, and this solution favors security. This time, the insurance company will contractually guarantee you a minimum of between 80% and 95%, then add surpluses according to its results. They are generally between 1.5% and 2%.

The mixed 3rd pillar

Return at risk

Guaranteed portion

Strengths and weaknesses

- Possibility of defining a guaranteed minimum between 10% and 90%.

- High yields

- Innovative, dynamic solution

- Insurance exclusivity

Potential yields

- 3% à 8%

How the mixed 3rd pillar works (insurance only) :

Insurance companies have developed a solution that combines security and returns. With this mixed solution, you can choose a contractual guaranteed minimum between 10% and 90%. The remainder will be invested in an investment fund or index to achieve a high return.

The advantage of this solution is that it combines yield and security. But you need to have a medium- to long-term objective to make it really worthwhile.

The 3rd pillar in investment funds

Return at risk

Guaranteed portion

Strengths and weaknesses

- Very high yield potential

- Wide choice of funds and investment themes

- High risk because nothing is secure

Potential yields

- 4% à 10%

- Possible negative returns

How the 3rd pillar works with investment funds :

Whether you use a bank or an insurance company, your money will be invested on the financial markets in an investment fund.

This is the solution that will give you the best performance of all. However, you should be aware that you are dependent on the financial markets, so a total loss is theoretically possible. It is therefore recommended for the discerning, and a careful choice of funds should be made.

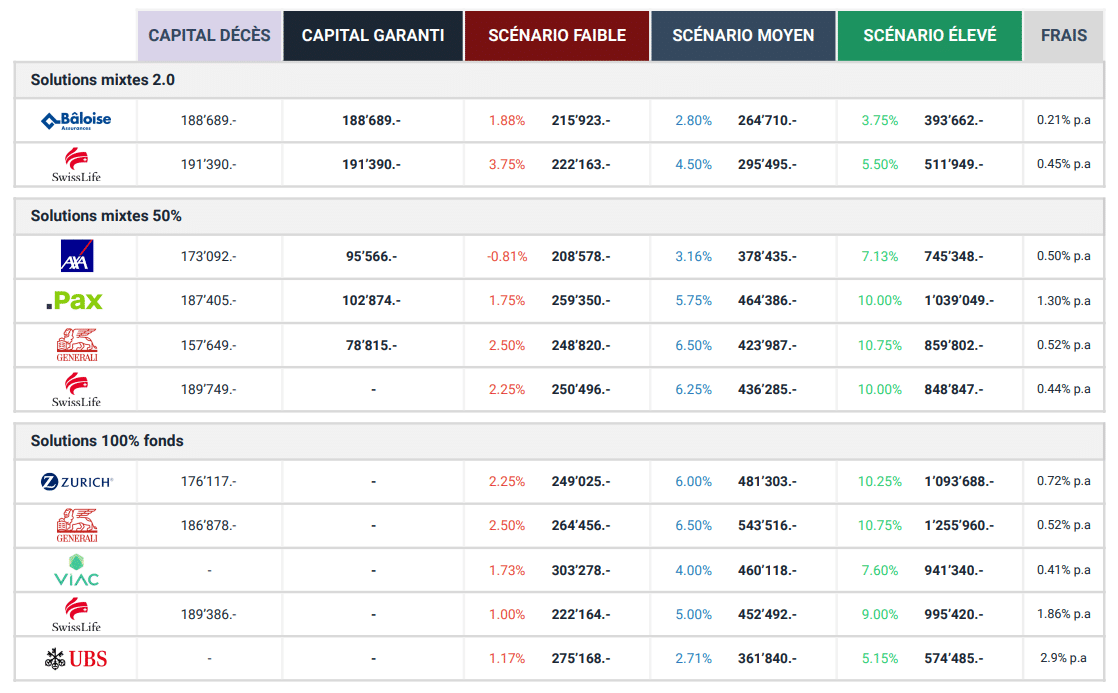

Example of a 3rd pillar comparison

- Ask us all your questions

- Request as many variants as necessary

- We're with you every step of the way, free of charge.