The 3rd pillar in 2026

The 3rd Pillar 2026

There are only 2 companies left that allow cross-border commuters to benefit from the advantages of the 3rd pillar. What about the future? Today, it is impossible to know whether these companies will remain open to new cross-border contracts or not. That’s why it’s so important to take advantage of your cross-border 3rd pillar now.

In addition, it has been confirmed that Pillar 3A and Pillar 3B will continue to be deductible in future. See theimpact of the new law of January 1, 2021 on the taxation of cross-border 3rd pillars.

It would be a shame to miss this opportunity and miss out on the many benefits of the 3rd pillar.

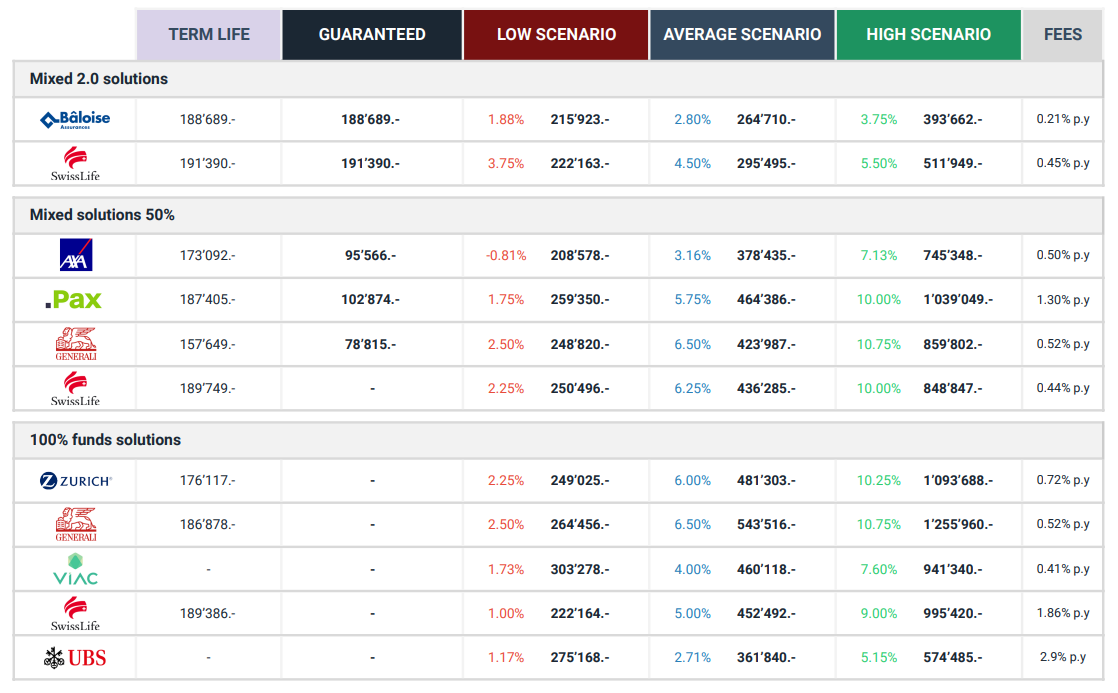

Example of a 3rd pillar comparison

- Ask us all your questions

- Request as many variants as necessary

- We're with you every step of the way, free of charge.

What are the advantages for a cross-border commuter in 2026?

Here are some examples of the main advantages of the 3rd pillar for cross-border commuters:

- Taxation: Reduce your taxes while saving for your projects

- Guaranteed capital: A minimum capital guaranteed from the moment the contract is signed

- Yields: Possible yields between 2% and 10%.

- Protection: Possibility of obtaining protection in the event of disability or death

- Safe Haven: Saving in Swiss francs, a historically solid currency

How much can I deduct with a cross-border 3rd pillar in 2026?

Here are the maximum premium amounts that can be deducted in Switzerland with a cross-border 3rd pillar in 2026:

- Linked 3rd pillar 3A : chf 7,258 / year per person.

- For the Canton of Geneva it is also possible to deduct the 3rd pillar (3b) up to :

- chf 2,200 / year per person.

- chf 3,300 / year for a married couple

- chf 900.- / additional children

How do I deduct my 3A or 3B?

From January 1, 2021, you will need to file an ordinary tax return in order to deduct your 3rd pillar 3A and 3B. It is no longer possible to make a simple rectification, as was previously the case for the 3A. The amount of the premium you pay on your 3rd pillar savings (maximum chf 7’053.- / year and per person with an income in Switzerland) will reduce your taxable income.

As a result, your tax rate will drop, allowing you to save up to chf 2,900 in taxes.

This sum will be paid to you once you have applied for quasi-resident status and declared your 3rd pillar status as a cross-border commuter.

What are the conditions for withdrawing your 3rd pillar 3A cross-border pension?

The state, which grants substantial tax savings, has set certain rules for the 3A (linked) cross-border 3rd pillar:

Withdrawal conditions 3A :

-

- Devenir Propriétaire – Home ownership in Switzerland or France

- Permanent departure from Switzerland or frontier status

- Becoming independent

- In the event of permanent disability