The 3rd pillar in 2026

What is the purpose of 3rd pillar?

You’ve probably heard of the Swiss 3-pillar system? The 3rd pillar is the part of private savings that supplements the 1st pillar (AVS, Ai, APG) and the 2nd pillar (LPP, LAA). The first two pillars are no longer enough to guarantee you a comfortable retirement. Worse still, even if you’ve worked all your life and paid all the required contributions, you can expect to have about a third less income when you retire.

It therefore complements your savings and gives you stable financial security in retirement. This is the main purpose of a 3rd pillar, but it’s not the only one, and we’re going to find out which ones.

How does a 3rd pillar work?

Switzerland is one of the countries with the highest proportion of private savings. It is interesting to note that today 60% of active people have a 3rd pillar. But how does it really work, and what are its advantages?

The very principle of a third pillar is to deposit savings capital in a pension institution(3rd pillar in a bank or insurance company) . You can choose from a range of investments, from the riskiest to the most secure. Well aware of the need for private savings, the Confederation will encourage your savings through tax breaks, and in return will set the legal framework for this 3A. We’ll go into more detail later.

Once you’ve chosen your investment, you decide how often you’d like to make payments, and how much you’d like to pay in, within the legal limits that simply have to be respected(maximum deductible amount). We advise you to stick to your budget and not to overpay at the outset, as it is above all important to make regular, long-term payments. The aim is to achieve your goal: a well-deserved retirement… but not only that, let’s find out why?

What are the conditions for withdrawing from the 3rd Pillar A?

Although the main aim of the 3A is to guarantee you a sufficient income in retirement, it may have other purposes, and these are therefore among the exceptions or conditions for withdrawals from your 3rd pillar. These withdrawal conditions are therefore also savings targets.

The stone. Isn’t that also one of life’s goals? Owning your own home is therefore one of the first conditions for withdrawal. Please note that this rule only applies to principal residences. In some cases, it will also be possible to use your third pillar for certain renovation projects or to pay off your mortgage. This is one of the withdrawal conditions, but it’s not the only one. Let’s discover the other 5.

Then comes pre-retirement. In fact, you can withdraw your 3rd pillar up to 5 years before the legal retirement age. Today it is 65 for men and 64 for women. You can therefore withdraw your capital between the ages of 59 (for women) and 60 (for men). Beware: the legal retirement age may well change, and we may have to add a few more years before this well-deserved pre-retirement.

if you decide to leave Switzerland permanently and settle abroad, you can withdraw your 3rd pillar. Unlike the rules for withdrawing from a 2nd pillar plan, you can withdraw your assets regardless of your country of destination. All you need to do is leave Switzerland permanently at the time of withdrawal. You can then return to Switzerland without having to pay back your 3rd pillar. To err is human, isn’t it?

Unfortunately, serious disability can occur, and the 3rd pillar is also intended to provide for the future. It would therefore be possible to withdraw your 3rd pillar assets if you were to become 100% disabled. Be careful, however, as some 3rd pillars offer protection against disability and death, and withdrawing your assets would mean losing this protection.

is another important life goal. Becoming self-employed within the meaning of the AHV also allows you to use and withdraw your 3rd pillar. You will have 1 year from the date you obtain the status to withdraw your 3rd pillar.

more technical and less well known, this option may prove interesting if you wish to increase your 2nd pillar pension. However, buy-backs should still be possible, and we advise you to plan your retirement with a specialist.

How to compare offers?

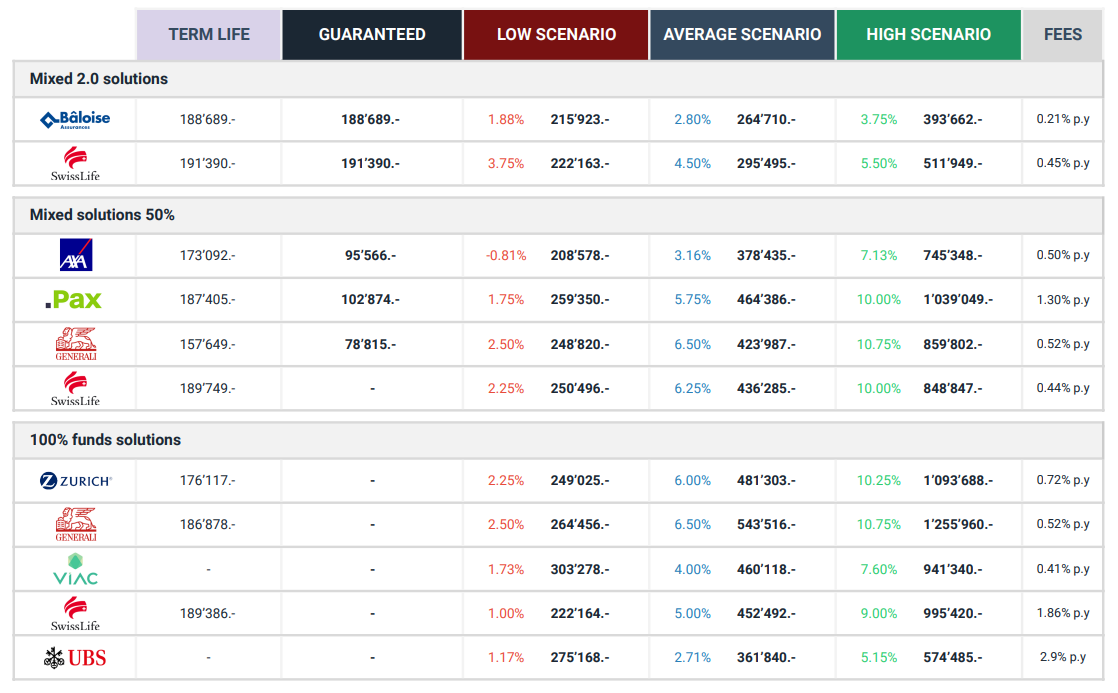

To help you compare the market as a whole, we have developed a neutral comparison of 41 banking and insurance solutions, based on a questionnaire and personalized online answers.

Depending on your choices, you will receive a comparison of the best offers corresponding to your choices, all from the comfort of your own home. If you like our advice, we invite you to try out our 3rd pillar comparator.

There must be around 150 different 3rd pillar offerings in Switzerland, but are they really all the same? Absolutely not. Here are the 3 most important tips.

First of all, we advise you to define the type of investment you are looking for. In fact, it’s impossible to get everything, and you’ll have to choose between a maximum-security investment with low returns, or an investment in funds that can achieve high returns but no security. There are also solutions that combine the two. Not all establishments offer the same types of investments, or are the best in the same investment profile. So it’s important to compare and be open to the market as a whole.

The next step is to define your priority objectives. In fact, these objectives will probably influence the estimated duration of your 3rd pillar, and the investment period will therefore impact your choice of solution. Some solutions are best for the short term, while others are best for the long term. So this is an important step.

So back to our main tip. Compare…compare and compare. It’s important to get a clear, neutral comparison of the market as a whole. This comparison will enable you to analyze guarantees, projected returns and past performance.

Example of a 3rd pillar comparison

- Ask us all your questions

- Request as many variants as necessary

- We're with you every step of the way, free of charge.

What is the 3A tax system?

Lower taxes. Isn’t it nice to be able to save for yourself and lower your taxes at the same time? Well, it is, and it’s one of the main reasons why so many people open a third pillar. Although deductible amounts are capped at CHF 7,056 per person per year, the tax benefits of this payment can be substantial. On average, you’ll save 30% of the amount invested, equivalent to CHF 2,116 a year.

During the entire compounding period, your savings are not taxed. Neither profit nor wealth. It is therefore a highly effective tax tool. You should be aware, however, that capital gains tax will be levied when the funds are withdrawn. This tax is of course clearly lower than the savings made year after year, and can even be optimized (how to optimize capital tax on a 3rd pillar 3A).

Which to choose, 3A or 3B?

We’ve just learned about the taxation of the 3A or linked 3rd pillar, as it is the main 3rd pillar in Switzerland. The 3A is deductible in all cantons and can be used for banking and insurance purposes. But it’s not the only pillar.

In reality, there are two types of 3rd pillar. Visit 3rd pillar 3A Linked and the 3rd pillar 3B Free. They differ mainly in terms of taxation, contractual term, beneficiary clause, withdrawal conditions and maximum amount.

Unlike Pillar 3A, the free Pillar 3B is not tax-deductible, except in Geneva and Fribourg, where there is an exception for Pillar 3B. So, especially if you live in one of these two cantons, it’s worth taking a closer look at the difference between a 3rd pillar 3B and 3A.