- 41 banks and insurance companies see the list

- Received in 3 minutes

- No need to speak to an advisor first!

- 🎁 CHF 200 free for any 3rd pillar insurance!

Third Pillar

Deduct 36,288.00 / year in taxes.

- 41 banks and insurance companies

- Customized comparison

- Received in 3 minutes

Flash offer until March 10, 2026

CHF 200 free with all new 3rd pillar insurance!

Is the 3rd pillar 3A for the self-employed tax-deductible?

Absolutely! You can deduct up to 20% of your income per year, to a maximum of CHF 36,288.

As official partners of almost the entire Swiss market, we are directly remunerated by these 41 companies, at no extra cost to you.

How can we be sure that our third-pillar advice is neutral?

Not all companies pay us the same, but this has no bearing on the advice we give you. Our Google ratings and reviews bear witness to this!

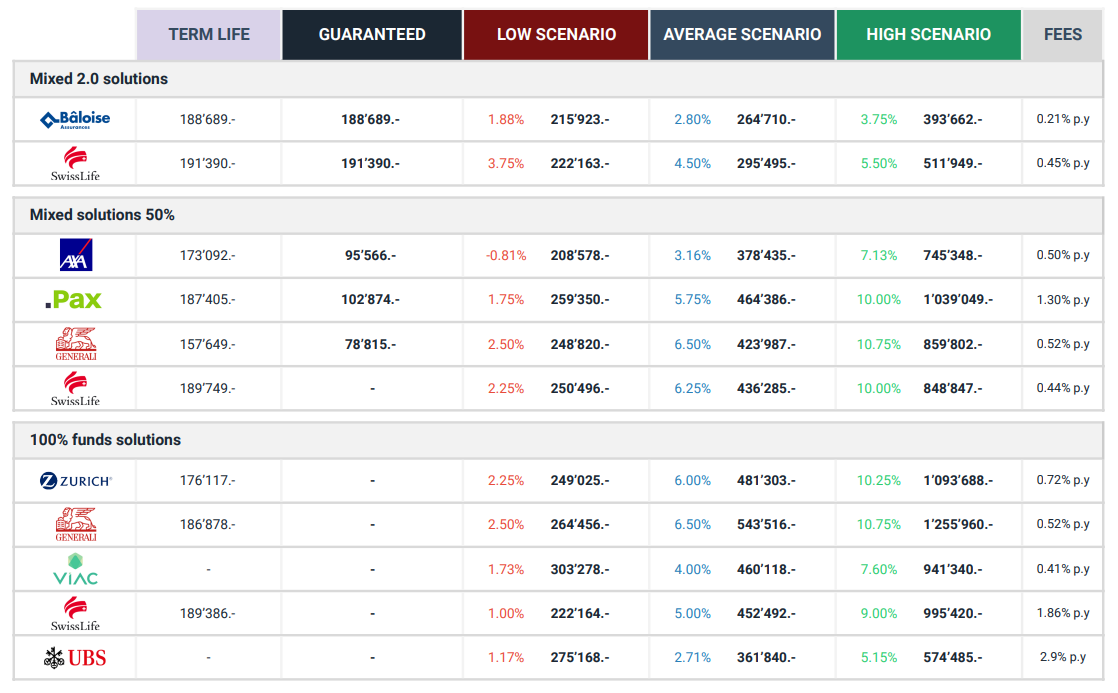

Is our 3rd pillar comparator really transparent?

Unlike the rest of the Swiss market, we include all 3rd pillar offers direct from the companies in your comparison. This way, you can verify all the figures we give you.

I highly recommend him!

David Bolognesi explained everything clearly and simply.

I'm very grateful for his honesty.

He helped me to clearly understand all the details of Pillar 3a and guided me towards the solution best suited to my personal situation.

I am very satisfied with his advice and support. Thank you very much.

Thanks for the effort in my case.

Once again, thank you Sparta Group.

I wish you all the best for the future.

I got in touch with David who was very transparent and efficient.

I like his style and appreciate his time.

your kindness and positive attitude are much appreciated.

Yours faithfully Denis Thioly

Always ready to provide support and further explanations.

Personalized service and fast turnaround. I am delighted!

I'd certainly recommend their service.

Thank you very much.

I highly recommend SpartaGroup's services.

We’ll support you all the way and beyond, free of charge.

The importance of comparing Swiss 3rd pillar 3A products for the self-employed

The Swiss pension system is structured around three pillars, each with a specific role to play in guaranteeing the financial security of its citizens. The self-employed third pillar, also known as personal pension provision for the self-employed, is particularly essential for self-employed professionals, who are often more exposed to financial risks.

The self-employed 3rd pillar enables them to build up voluntary savings to make up for the shortcomings of the first two pillars, which are generally less advantageous or less accessible to them. Unlike salaried employees, who are automatically covered by a compulsory occupational pension scheme (2nd pillar), self-employed people have to make their own provision for retirement, disability or death.

Here’s why it’s so important to compare independent third pillar offers using a specialized calculator:

Tax optimization for the self-employed

The self-employed benefit from particularly attractive tax opportunities under the 3A third pillar. The amounts paid in are deductible from taxable income, considerably reducing their annual tax burden. A detailed comparison will help you identify the offer that maximizes this advantage.

Returns and conditions tailored to self-employed workers

Not all institutions offer equally advantageous products for the self-employed. It’s essential to evaluate rates of return, specific early withdrawal conditions for professional investments or flexibility in the face of income variations inherent in self-employment.

Flexibility essential for self-employed workers

As self-employed people’s incomes can fluctuate, flexibility in payments is vital. Some self-employed 3rd pillar products allow you to freely adjust the amounts or temporarily suspend payments, ensuring management adapted to your economic activity.

Customized cover

Self-employed third pillar contracts can include tailor-made cover, such as disability or death insurance, specifically adapted to the needs and risks of the self-employed. Careful comparison guarantees adequate protection.

Cost transparency

This comparison helps to identify hidden or high costs that can significantly reduce net returns. It is vital for self-employed people, who manage their finances directly, to have a clear view of these costs to safeguard their long-term interests.

Encouraging competitiveness

Regularly comparing offers stimulates competitiveness between financial institutions, encouraging innovation and continuous improvement in the solutions offered to the self-employed.

Effective preparation for the future

The self-employed third pillar is essential to ensure a comfortable retirement, the realization of future projects or financial security in the event of unforeseen circumstances. By using a neutral, free comparison service, you can be sure of making the right choices to help you achieve your personal and professional financial goals.

In short, the independent third pillar is an essential component of the Swiss pension system for the self-employed. Choosing carefully with the help of a suitable comparator not only guarantees maximum tax and financial optimization, but above all offers lasting peace of mind for you and your loved ones.