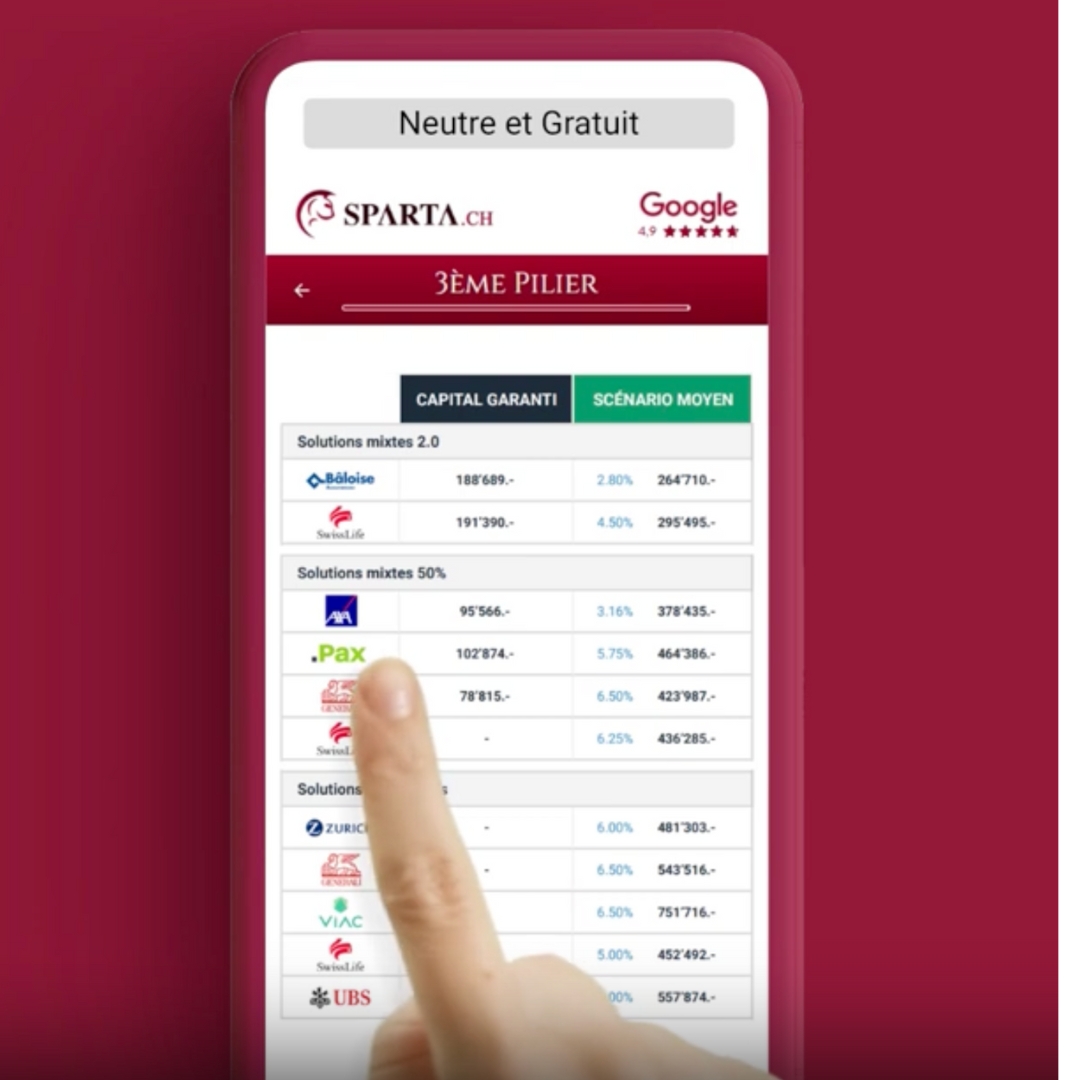

Is Swisslife Third Pillar in the top 10?

Swisslife 3rd pillar highlights

Wide choice of funds

SwissLife's third pillar offers include a wide choice of funds, including active, passive and sustainable (ESG) options, from Switzerland, Europe or the World. You can customize your investment strategy according to your risk profile and long-term objectives.

Solutions for every profile

The Swisslife FlexSave Duo 3rd pillar solution is highly guaranteed and can withstand bad years for the funds. It is therefore popular with banks for indirect amortization.

The other secure solution, Dynamic Elements Duo, has a customizable secure portion and a very good yield, making it an interesting compromise.

The lien option: A must for indirect amortization

Swisslife offers a unique, inexpensive option, which allows you to increase the surrender values at the beginning/middle of the contract in the event that you want to take your money out of the 3rd pillar for a property purchase and continue your solution with Swisslife. This is a great advantage for people planning to use their 3rd pillar money for a short/medium-term purchase.

What you need to know about Swisslife's 3rd pillar solutions 3A and 3B

📂 Solution names : FlexSave Duo (Classic 2.0), Dynamic Elements Duo (Mixed), Premium Vitality Duo (100% funds)

📂 Recommendation : Premium Vitality Duo (100% funds) offers such a wide range of funds that, if you choose well, you can achieve very good returns. Here are the details:

📂 Plan type: 3a / 3b

📈 Type of solution: 100% Funds

📈 Fund themes available Swiss, Sustainable, Technology, AI, Data, Gold, Materials, World, Europe, Asia, etc.

📈 Possible collateral : None, but possibility of increasing the bond component to reduce risk

🌐 Acceptedtés All

🌐 Licenses accepted : C license, B license (if death coverage), Ci license

🌐 Cross-border commuters accepted: No ❌

🌐 American nationality accepted : No ❌

📆 Minimum term: 12 years

📆 Maximum duration: Up to 5 years after retirement age

📆 Minimum age : 18

📆 Possible start date : Within the next 2 months

📆 Premium split: Monthly only

💲 Minimum annual payment CHF 1,200

💲 Bonus increase after the event : Possible ✅

💲 Additional payments after the fact : Possible ✅

💲 Automatic adjustment of 3a premiums to annual maximums Possible ✅

🤚 Breaks in the contract Possible ✅per 1-year period, maximum 3 in all and after paying for at least 3 years

🔁 Switch between 3A and 3B: Possible ✅on payment of first premium

✍ S ubsequent fund change : Possible ✅free of charge